According to reports, Intel CEO Lip-Bu Tan is considering stopping the promotion of the company's 18A manufacturing process (1.8nm) to foundry customers and instead focusing on the next-generation 14A manufacturing process (1.4nm) in an effort to secure orders from major clients such as Apple and Nvidia. If this shift in focus occurs, it would mark the second consecutive time Intel has downgraded its priorities. The proposed adjustment could have significant financial implications and alter the trajectory of Intel's foundry business, effectively leading the company to exit the foundry market in the coming years. Intel has informed us that this information is based on market speculation. However, a spokesperson provided some additional insights into the company's development roadmap, which we have included below. "We do not comment on market rumors and speculation," an Intel spokesperson told Tom’s Hardware. "As we have said before, we are committed to strengthening our development roadmap, serving our customers, and improving our future financial situation."

Since taking office in March, Tan announced a cost-cutting plan in April, which is expected to involve layoffs and the cancellation of certain projects. According to news reports, by June, he began sharing with colleagues that the appeal of the 18A process—designed to showcase Intel's manufacturing capabilities—was declining for external customers, leading him to believe it was reasonable for the company to stop offering 18A and its enhanced 18A-P version to foundry clients.

Instead, Tan suggested allocating more resources to complete and promote the company's next-generation node, 14A, which is expected to be ready for risk production in 2027 and for mass production in 2028. Given the timing of 14A, now is the time to start promoting it among potential third-party Intel foundry customers.

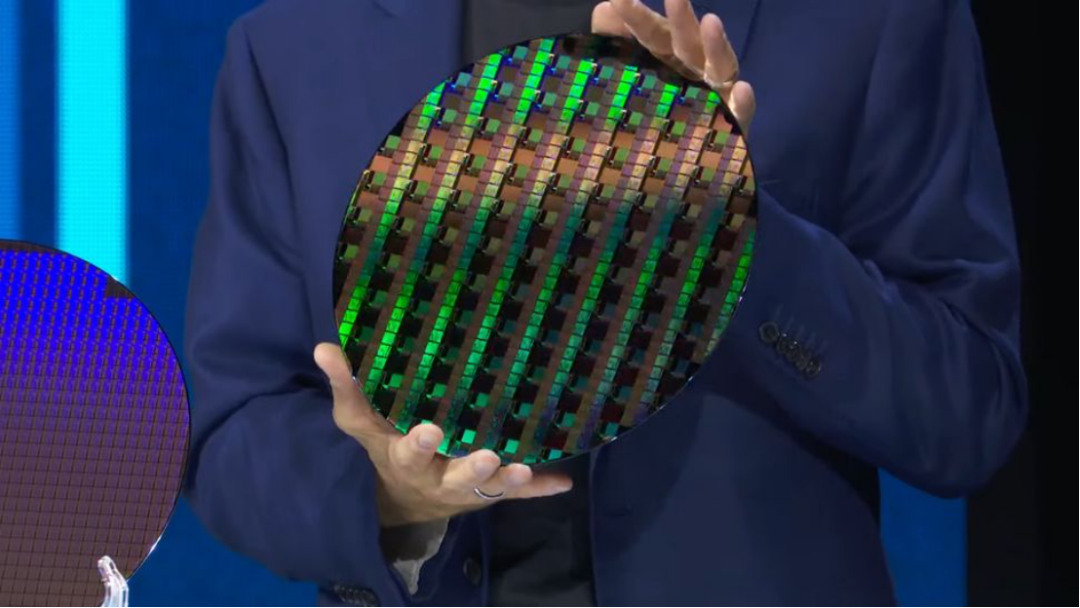

Intel's 18A manufacturing technology is the company's first node to utilize its second-generation RibbonFET gate-all-around (GAA) transistors and PowerVia back-side power delivery network (BSPDN). In contrast, 14A employs RibbonFET transistors and PowerDirect BSPDN technology, which delivers power directly to the source and drain of each transistor through dedicated contacts, and is equipped with Turbo Cells technology for critical paths. Additionally, 18A is Intel's first cutting-edge technology compatible with third-party design tools for its foundry customers.

According to insiders, if Intel abandons external sales of 18A and 18A-P, it will need to write off a substantial amount to offset the billions of dollars invested in developing these manufacturing technologies. Depending on how development costs are calculated, the final write-off could reach hundreds of millions or even billions of dollars.

RibbonFET and PowerVia were initially developed for 20A, but last August, the technology was scrapped for internal products to focus on 18A for both internal and external products.

The rationale behind Intel's move may be quite simple: by limiting the number of potential customers for 18A, the company could reduce operational costs. Most of the equipment required for 20A, 18A, and 14A (excluding high numerical aperture EUV equipment) is already in use at its D1D fab in Oregon and its Fab 52 and Fab 62 in Arizona. However, once this equipment is officially operational, the company must account for its depreciation costs. In the face of uncertain third-party customer orders, not deploying this equipment could allow Intel to cut costs. Furthermore, by not offering 18A and 18A-P to external customers, Intel might save on engineering costs associated with supporting third-party circuits in sampling, mass production, and production at Intel fabs. Clearly, this is merely speculation. However, by ceasing to offer 18A and 18A-P to external customers, Intel will be unable to showcase the advantages of its manufacturing nodes to a wide range of clients with various designs, leaving them with only one option in the next two to three years: to collaborate with TSMC and use N2, N2P, or even A16.

While Samsung is set to officially begin chip production on its SF2 (also known as SF3P) node later this year, this node is expected to lag behind Intel's 18A and TSMC's N2 and A16 in terms of power, performance, and area. Essentially, Intel will not be competing with TSMC's N2 and A16, which certainly does not help in winning potential customers' confidence in Intel's other products (such as 14A, 3-T/3-E, Intel/UMC 12nm, etc.). Insiders have revealed that Tan has asked Intel's experts to prepare a proposal for discussion with the Intel board this fall. The proposal may include stopping the signing of new customers for the 18A process, but given the scale and complexity of the issue, a final decision may have to wait until the board meets again later this year.

Intel itself has reportedly declined to discuss hypothetical scenarios but confirmed that the primary customers for 18A have been its product divisions, which plan to use the technology to produce the Panther Lake laptop CPU starting in 2025. Ultimately, products like Clearwater Forest, Diamond Rapids, and Jaguar Shores will utilize 18A and 18A-P.

Limited Demand? Intel's efforts to attract large external customers to its foundry are crucial for its turnaround, as only high volumes will allow the company to recoup the costs of the billions it has spent developing its process technologies. However, aside from Intel itself, only Amazon, Microsoft, and the U.S. Department of Defense have officially confirmed plans to use 18A. Reports indicate that Broadcom and Nvidia are also testing Intel's latest process technology, but they have yet to commit to using it for actual products. Compared to TSMC's N2, Intel's 18A has a key advantage: it supports back-side power delivery, which is particularly useful for high-power processors aimed at AI and HPC applications. TSMC's A16 processor, equipped with a super power rail (SPR), is expected to enter mass production by the end of 2026, meaning 18A will maintain its advantage of back-side power delivery for Amazon, Microsoft, and other potential customers for some time. However, N2 is expected to offer higher transistor density, which benefits the vast majority of chip designs. Additionally, while Intel has been running Panther Lake chips at its D1D fab for several quarters (thus, Intel is still using 18A for risk production), its high-volume Fab 52 and Fab 62 began running 18A test chips in March of this year, meaning they will not start producing commercial chips until late 2025, or more precisely, early 2025. Of course, Intel's external customers are interested in producing their designs in high-volume factories in Arizona rather than in development fabs in Oregon.

In summary, Intel CEO Lip-Bu Tan is considering halting the promotion of the company's 18A manufacturing process to external customers and instead focusing on the next-generation 14A production node, aiming to attract major clients like Apple and Nvidia. This move could trigger significant write-offs, as Intel has invested billions in developing the 18A and 18A-P process technologies. Shifting focus to the 14A process may help reduce costs and better prepare for third-party customers, but it could also undermine confidence in Intel's foundry capabilities before the 14A process is set to enter production in 2027-2028. While the 18A node remains crucial for Intel's own products (such as the Panther Lake CPU), limited third-party demand (so far, only Amazon, Microsoft, and the U.S. Department of Defense have confirmed plans to use it) raises concerns about its viability. This potential decision effectively means that Intel may exit the broad foundry market before the 14A process is launched. Even if Intel ultimately chooses to remove the 18A process from its foundry offerings for a wide range of applications and customers, the company will still use the 18A process to produce chips for its own products that have already been designed for that process. Intel also intends to fulfill its committed limited orders, including supplying chips to the aforementioned customers.

Post time: Jul-21-2025